Wind Mitigation Inspection

Wind Mitigation Inspection

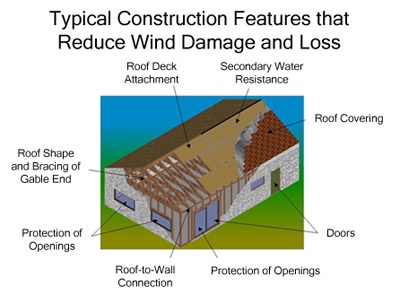

The diagram above shows features that reduce wind damage. The majority of existing houses have one or many wind-resistive construction features. These attributes may qualify for some insurance reductions. Also, houses built after 1994 in Miami-Dade or Broward Counties and houses built after 2002 in the rest of the state generally have many wind-resistive construction features and will more than likely qualify for money-saving credits.

Since insurance company discounts vary per company, we recommend contacting your agent or insurance company to determine the possible worth of the values for your home.

The Florida State government compels insurance companies to offer a reduction in premiums for wind mitigation features listed on their form. We have performed hundreds of insurance inspections (wind mitigation inspection/4-point inspection). We look forward to helping you reduce your insurance premiums by performing an inspection. If you’ve been told that your house doesn’t qualify for discounts, we can verify/point you in the right direction to have retrofit work done so you can start saving money on your premiums, often up to 50% off.

To qualify for insurance premium discounts, insurance companies require a wind mitigation form to be filled out by licensed individuals to certify certain construction features.

- Age and type of roof coverings.

- Whether roof decks have been installed with large enough nails and close spacing-ideal is (8d nails spacing)

- Type of straps holding the roof trusses to the walls.

- Type of protection of openings such as windows and glass doors with impact glass or shutters.

- Secondary Water Resistance (SWR) aka peel & stick, provides an additional barrier to reduce the likelihood of the roof from leaking if the primary roof covering comes off in a windstorm.

- Newly built homes built to the Florida Building Code since March 1, 2002

- Homes were built to the South Florida Building Code in Miami-Dade and Broward Counties after 1994.

How Much Will I Save?

The dollar value of the premium discounts depends on three factors.

1. The number of discounts your home qualifies for – Some discounts are as much as 10%, while others are only 2%. The more wind-resistant features your home has, the higher the total discount will be. The discounts can be as much as 30% or more of the wind portion of the insurance premium. (The percentage of your premium that is for windstorm losses is provided on your policy declaration page).

2. The location of your home – Insurance rates vary by location within the state. If the wind insurance percentage rates are high, then the discounts will result in more savings for a house in a high-cost area versus the same house in a lower-cost area.

3. The value of your home – Discounts are computed as a percentage of the wind portion of your insurance for your home. Relatively expensive homes have higher premiums; hence, the amount of the discounts will increase as the value of the home increases.

How Is a Wind Mitigation Inspection Accomplished?

At the arranged time, the inspector will be at your home and complete the survey. As part of the inspection, the inspector will conduct a go inside the attic and use a device to identify the roof deck nailing pattern, the use of an SWR, the type of sheathing, and roof to wall connection.

The results of the inspection are typically sent to your insurance company (if you have provided them to us in advance) and forwarded to you as well.

How Much Is a Wind Mitigation Inspection?

For homes with less than 5000 square feet (under roof), the cost of a survey is $125.